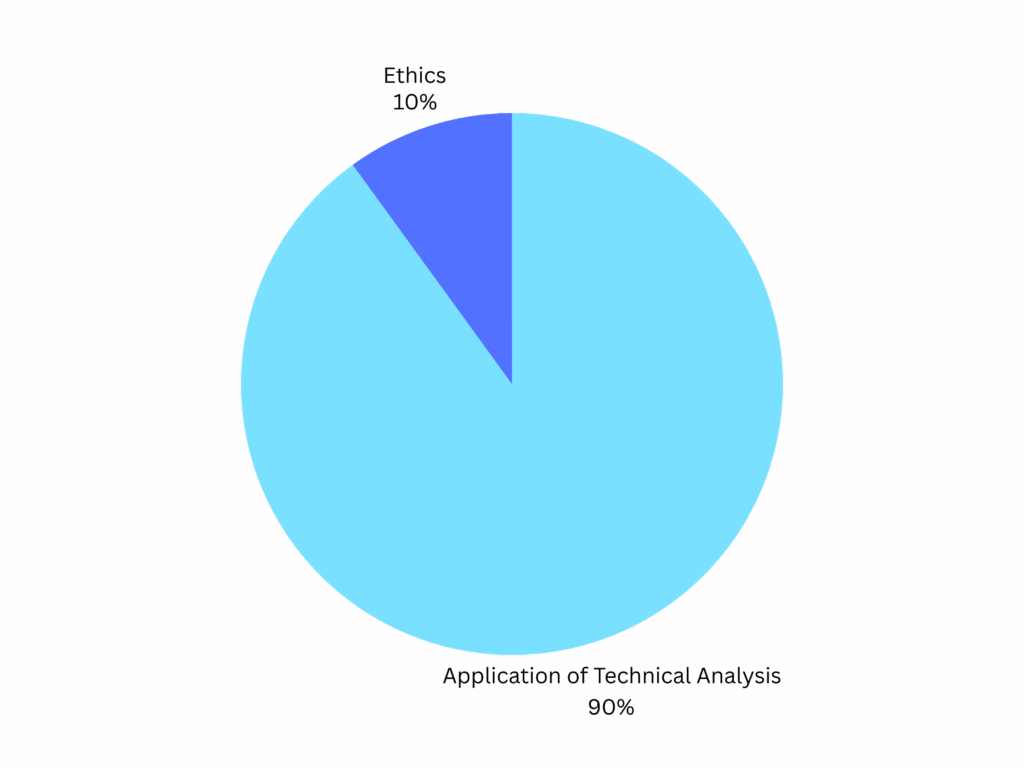

CMT LEVEL 3 COURSE

Syllabus of CMT Level 3

I. Application of Technical Analysis

i. Analyze and interpret charts for entries and exits using

classical charts, patterns, and indicators.

ii. Develop plans to address risk using, e.g., technical,

behavioral, quantitative analysis, and leverage.

iii. Analyze the output from models to determine their suitability

for implementation.

iv. Establish weighting of assets and securities using, e.g.,

relative strength, trend, momentum.

v. Integrate volatility measures into price forecasting and trade

management.

II. Ethics

Section One: Quantifying and Managing Risk

1. Perspectives on Risk

Section Two: Classical Chart Analysis

1. Classical Chart Patterns

2. Candlesticks within a Broader Technical Analysis Framework

3. Case Studies in Point-and-Figure Analysis

Section Three: Trend Analysis

1. Market Internals

Section Four: Technical Indicators

1. Anchored Volume Weighted Average Price Part 1

2. Anchored Volume Weighted Average Price Part 2

3. Bollinger Bands Advanced Implementation

Section Five: Volatility Analysis

1. Volatility Indexes Advanced Concepts

Section Six: Comparative Market Analysis

1. Relative Rotation Graphs (RRG) – Advanced Concepts

Section Seven: Systems and Quantitative Methods

1. Statistics of Backtesting

2. Systematic Approaches, Development, and Risk

3. Systematic Counter-Trend Trading and Position Sizing

4. Systematic Tactical Asset Allocation

5. Trading Systems

6. Advanced Quantitative Concepts

Section Eight: Topics in Portfolio Management

1. Bridging the Fundamental Gap Fusion Analysis

2. Portfolio Construction Employing Relative Strength and

Sector Rotation Strategies

3. A Practitioner’s Perspective on Portfolio Management

4. Digital Assets – Applying Technical Analysis

5. Fusion Analysis: Technicians and Fundamentalists

Working Together

6. Contrarianism, Crowd Behavior, and Overcoming Group

Biases

FEE Structure:

Course – CMT Level 3

Duration – 4 Months

Course Fees – Rs – 45,000/- Only