CMT LEVEL 2 COURSE

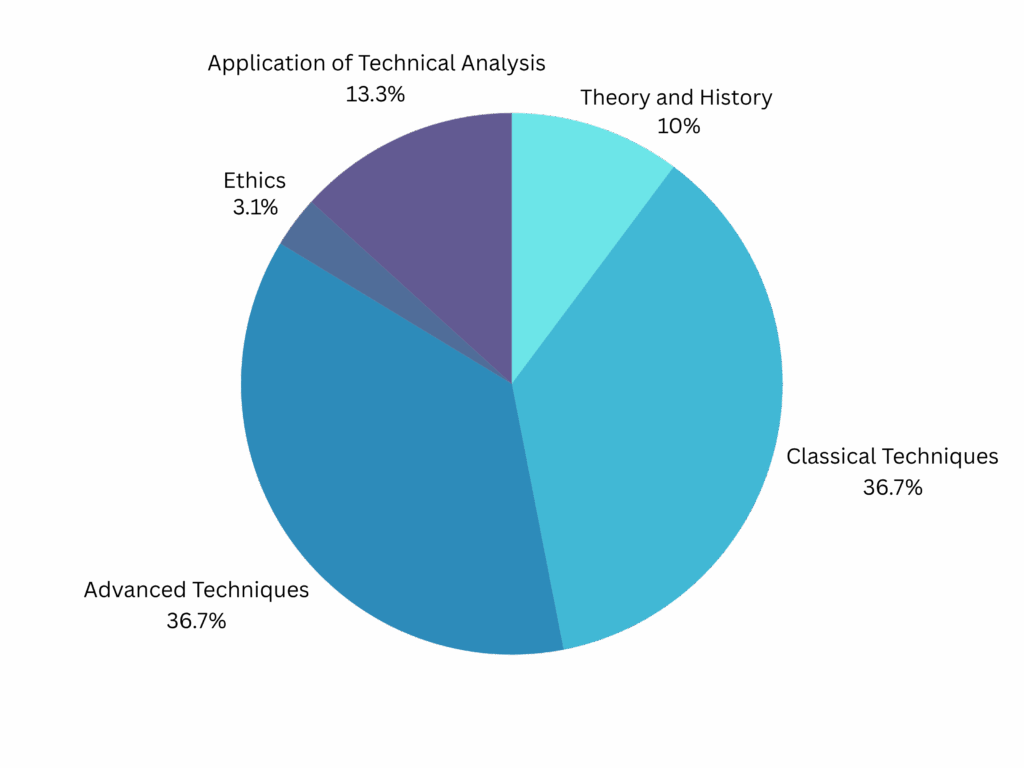

Syllabus of CMT Level 2

I. Theory and History

i. Evolution of Technical Analysis

ii.Key Concepts in Technical Analysis and Market Analysis

iii. Behavioral Finance

II. Classical Techniques

i. Chart Types and Construction

ii.Trend Analysis

iii. Chart Pattern Analysis

iv. Internal and External Technical Indicators

v.Cycles

III. Advanced Technique

i. Statistical Analysis

ii.Volatility Analysis

iii. Systematic Trading

iv. Cross-asset Analysis

v.Principles of Risk Management

IV. Application of Technical Analysis

i. Analyze and interpret charts for entries and exits using classical charts, patterns, and indicators.

ii.Develop plans to address risk using, e.g., technical, behavioral, quantitative analysis, leverage.

iii. Analyze the output from models to determine their suitability for implementation.

iv. Establish weighting of assets and securities using, e.g., relative strength, trend, momentum.

v.Integrate volatility measures into price forecasting and trade management.

V. Ethics

Section One: Theory and History of Technical Analysis

1. Alpha and Beta – Outperforming the Benchmarks

2. Fusion Analysis: Technical Analysis as Part of a Team Approach

Section Two: Behavioural Finance

1. 1 Anatomy of Market Bubbles

Section Three: Charts: Organizing Market Data

1. Charting Multiple Data Sets and Multiple Data Intervals

2. Market Profile

Section Four: Chart Pattern Analysis

1. Classical Chart Patterns

2. Candlestick Patterns in the Real World

3. Candlestick Analysis in the Real World

4. Point-and-Figure Pattern Analysis

Section Five: Trend Analysis

1. Price Trend and Volume

2. Market Internals

Section Six: Volatility Analysis

1. Extrapolating Price from Volatility

2. Volatility Risk Premium

3. Volatility Indexes and VIX Complex

Section Seven: Sentiment

1. Analysing Sentiment in the Stock Market

2. Analyzing Sentiment in the Derivatives Market

Section Eight: Statistics for Technicians

1. Inferential Statistics

Section Nine: Technical Indicators

1. Momentum and Indicator Interpretation Part 1

2. Momentum and Indicator Interpretation Part 2

3. Volume Weighted Average Price

4. Practical Applications of Bollinger Bands

Section Ten: Comparative Market Analysis

1. Advanced Applications of Relative Strength

Section Eleven : Cycle Analysis

1. Concepts in Cycle Theory

2. Applied Cycle Analysis

3. Analysis of Seasonal Cycles

4. The Elliott Wave Principle Part 1

5. The Elliott Wave Principle Part 2

6. The Elliott Wave Principle Part 3

Section Twelve: Systems and Quantitative Methods

1. Trading Systems

2. Applying Quantitative Techniques

FEE Structure:

Course – CMT Level 2

Duration – 4 Months

Course Fees – Rs – 40,000/- Only