CMT LEVEL 1 COURSE

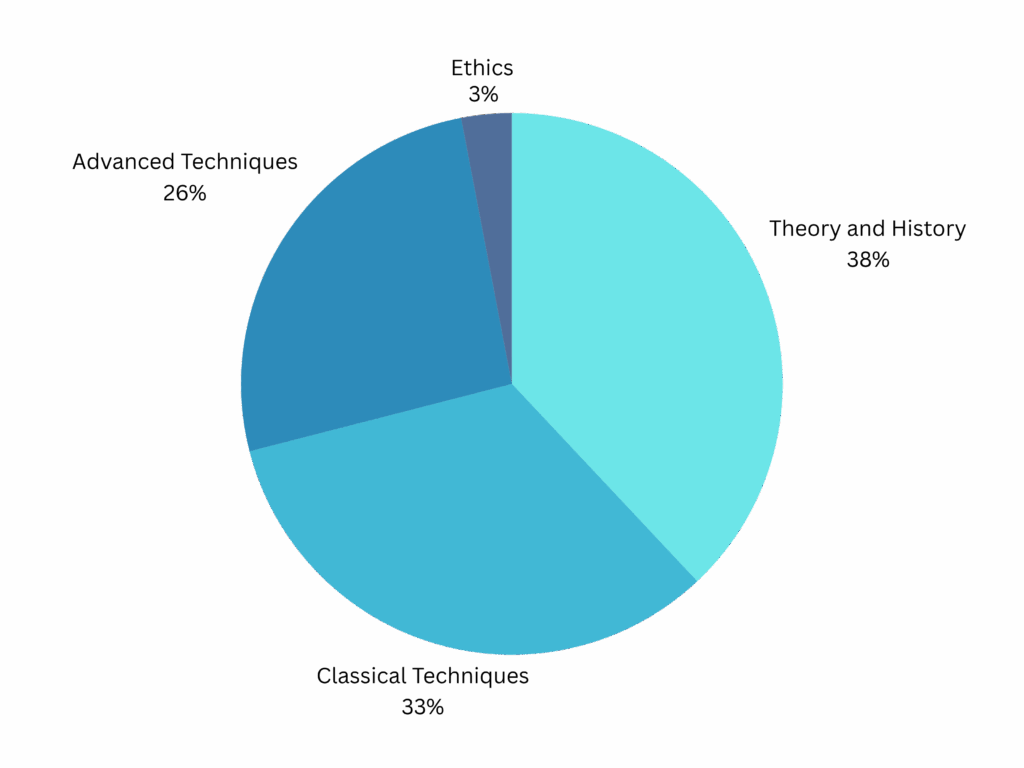

Syllabus of CMT Level 1

- Theory and History

- Evolution of Technical Analysis

ii.Key Concepts in Technical Analysis and Market Analysis

iii. Behavioral Finance

- Classical Techniques

- Chart Types and Construction

ii.Trend Analysis

iii. Chart Pattern Analysis

- Internal and External Technical Indicators

v.Cycles

III. Advanced Techniques

- Statistical Analysis

ii.Volatility Analysis

iii. Systematic Trading

- Cross-asset Analysis

v.Principles of Risk Management

- Ethics

Section One: Theory and History of Technical Analysis

- A Brief History of Technical Analysis

- The Dow Theory

- Markets, Instruments, Data and the Technical Analyst

- The Opportunity of the Efficient Markets Hypothesis

- The Fibonacci Sequence and The Golden Ratio

Section Two: Charts: Market Price Data

- An Overview of Charting

- The X Axis

- The Y Axis

- Charting Volume and Open Interest

Section Three: Trend Analysis

- Trend Primer: What is a Trend

- Trend Primer: A Trend’s Four Phases

- Trend Primer: Trend Identification and Following

- Introduction to Volume Analysis

- Volume, Open Interest, and Price

- Market Internals

Section Four: Chart Pattern Analysis

- Classical Chart Patterns

- Introduction to Candlesticks

- Introduction to Candlestick Patterns

- Basics of Point-and-Figure Charting

Section Five: Technical Indicators

- Moving Averages

- Technical Indicator Construction

- Introduction to Bollinger Bands

Section Six: Statistics for Technicians

- Introduction to Statistics Part 1

- Introduction to Statistics Part 2

- Introduction to Probability

Section Seven: Behavioral Finance

- Behavioral Finance

Section Eight: Sentiment

- Market Sentiment and Technical Analysis

- Sentiment Measured from Market Data

- Sentiment Measured from External Data

Section Nine: Cycle Analysis

- Foundations of Cycle Theory

- Common Cycles

Section Ten: Comparative Market Analysis

- Equities

- Indexes

- Fixed Income/Bonds

- Futures

- Exchange – Traded Products (ETPs)

- Foreign Exchange (Currencies)

- Digital Assets

- Options

- Introduction to Relative Strength

- Relative Strength and its Uses

- Section Eleven: Volatility Analysis

- The Meaning of Volatility to a Technician

- Measuring Historical Volatility

- Options Derived Volatility

Section Twelve: Systems and Quantitative Methods

- Introduction to Quantitative Methods

FEE Structure:

Course – CMT Level 1

Duration – 4 Months

Course Fees – Rs – 40,000/-Only