ABOUT CERTIFIED OPTION TRADER (COT PROGRAM)

If you are First time enter into the Stock Market and not yet try derivative options, then you are lucky to join this course Because Option are riskier product if you have no proper knowledge Please stay away.

And if you are a professional trader having good knowledge of option then definitely join this Option Trader Certification because I am damn sure you lose your hard money in option derivative.

OBJECTIVE OF COT PROGRAM:-

-

Master foundation of Option Basic Terminology & jargons.

-

Masterclasses for Option Based Profitable Strategies.

-

Strong & Deep Analysis on Option Chain & Option Money-ness

-

Focus on Volatility and Implied Volatility application

-

Application of Option-Greeks in Real Trading.

-

Selection of Best Strategies & Opportunity to create Smart profit.

Course Curriculum

• Option Contract Define

• Why option Contract need?

• Assets Class – options

Equity

Commodities

Currencies

Fixed Income Securities

• Option Component

Call option

Put option

• Real Examples – TO define Option Contract

• Option Types

• Option Expiry

Weekly Expiry

Monthly Expiry

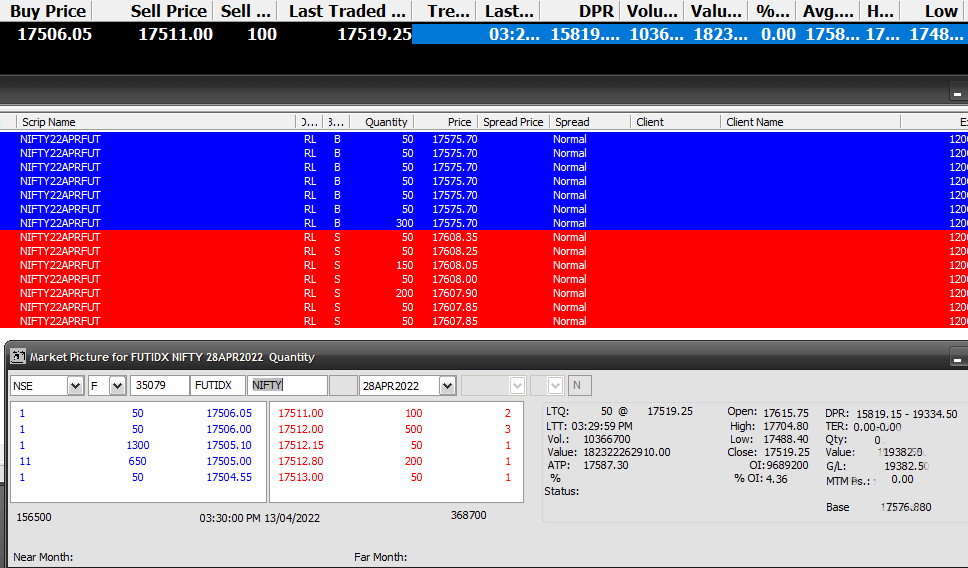

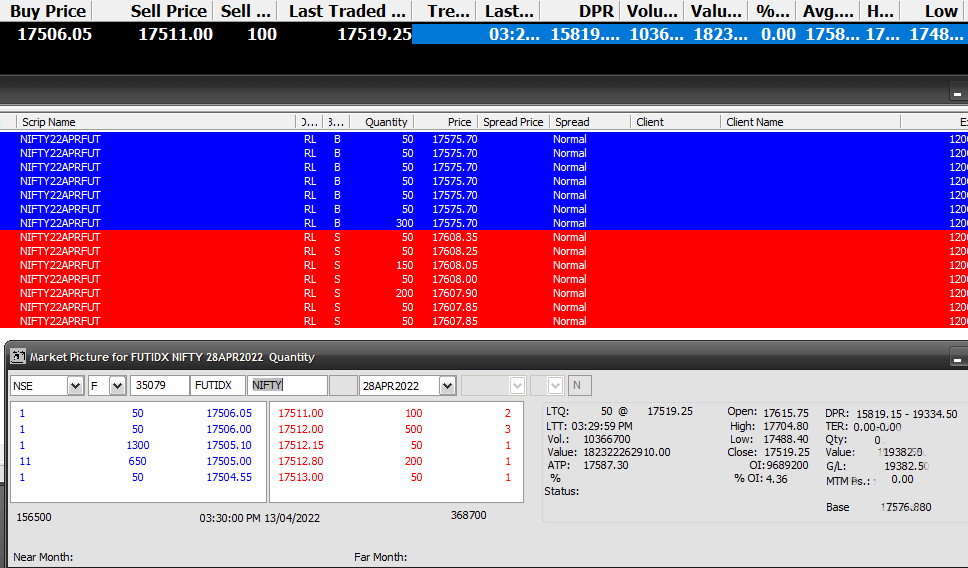

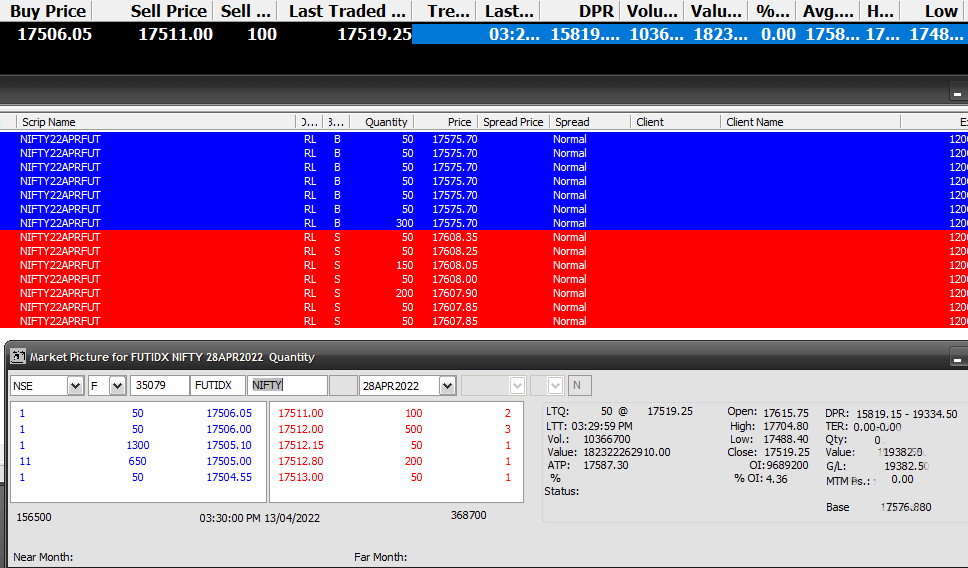

• Option Trading Software

Omnesys nest

Greeksoft

Volhedge

• Greeks

* Option Trading Mechanism

• Live Terminal Option Trades

• Option Contract Application

Option Hedging – Call Side

Option Hedging – Put Side

• Option Strategies:

Covered Call Writing

Protective Put

Strip- strap

Option Spread

Vertical / horizontal / Diagonal Spread

Bullish – Spread

Bearish – Spread

Straddle / Strangle

Butterfly / Condor

Box Spread

Ratio Spread

Iron Condor

Conversions

Christmas Tree Spread

Arbitrage Strategies

Put-Call Parity

• Option Sensitivity Tools – Greeks

Delta

Vega

Gamma

Theta

RHO

Implied Volatility

• Greeks Based Strategies:

Delta Hedging

Delta –Vega –Gamma Hedging

Theta Hedging

• Technical Analysis Based Option Strategies:

Delta Hedge with future & option

(using Chart Analysis)

• Option Valuation:

Option Pricing Theory

Binomial Option Model Application

Black Schole Option Model Application

SEBI NISM All Applicable EXAMs Covered in COT program –

-

NISM Series 1 Currency Derivative

-

NISM Series 8 Equity Derivative

-

NISM Series 16 Commodities Derivative

-

NISM Series 4 Interest Rate Derivative

-

NISM Series 13 Common Derivative

Program Details and Fee structure–

-

Program : Certified Option Trader

-

Duration - 2 Months

-

Fee - 25000