- Pitampura Delhi

- 9810428142

- info@financialcorridor.com

ABOUT CMT PROGRAM & CMT DESIGNATION

Chartered Market Technician (CMT) is a professional designation that confirms mastery in technical analysis of the financial markets. The CMT encompasses much more than the ability to read a chart. Candidates learn to read and fully understand point and figure, line and candlestick charts from price perspectives past, present and future. Candidates also learn the relationship between these prices and price patterns, as well as trends and what they mean, how to draw trend lines and how to determine if trends will continue or fade.

Candidates then advance their knowledge to indicators and how they work, how they are calculated and the meaning and purpose behind those calculations. Candidates will learn implied volatilities, put/call ratios and inferential statistics from correlation analysis to t-tests to regression analysis. They learn volume, breadth, short selling, sentiment gauges and intermarket analysis. While these examples name only a small portion of the technical skills learned from the three exams needed to become a CMT, the exams in themselves test a much wider knowledge of technical skills and analysis.

Many CMTs have moved forward with rich and rewarding careers. Some invented indicators or a unique trading methodology; some became teachers, analysts, mentors and authors. Some became independent traders, while many work for the exchanges, hedge funds, firms and brokerages that cover many different markets. The opportunities are immense and the rewards are great. Administered by the Accreditation Committee of the CMT Association, the program consists of three levels. CMT Level 1 and CMT Level 2 are multiple choice exams while CMT Level 3 is in essay form.

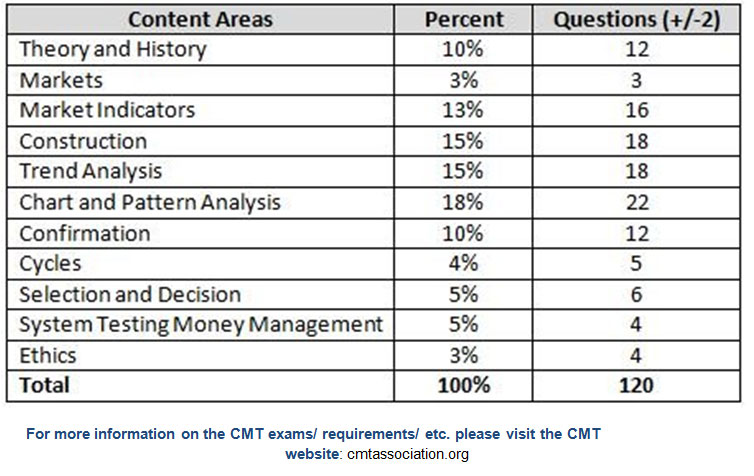

TOPIC AREAS FOR CMT PROGRAM

- Theory and history

- Markets

- Market Indicators

- construction

- Trend Analysis

- Chart and Pattern Analysis

- Confirmation

- cycles

- Selection and Decision

- System Testing Money Management

- Ethics